Life insurance 101

If you’re new to life insurance, it can be overwhelming to sift through all the information. Learn the basics and find out what you need to make an informed decision.

If you’re new to life insurance, it can be overwhelming to sift through all the information. Learn the basics and find out what you need to make an informed decision.

It’s a simple, affordable way to provide financial protection for the people who depend on you.

Term life insurance can give you peace of mind knowing your family is covered. A life insurance policy ensures that if you die, the people you love will receive a lump-sum payout, known as a death benefit.

With term life insurance:

Our coverage calculator helps estimate how much coverage you need to protect your family.

These are the two main types of life insurance. Each has pros and cons, but term life insurance tends to be more simple and affordable.

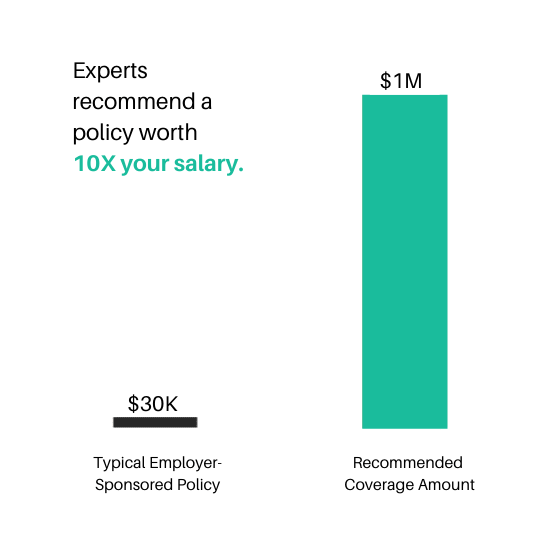

Group life insurance typically comes in the form of an employer-sponsored life insurance policy. You might already have some coverage provided to you as an employee benefit.

This type of policy might only provide a fraction of the coverage you need. For this reason, we recommend an individual term life insurance policy to supplement any coverage received through work.

The process of buying a term life insurance policy can vary based on the insurance company you choose, but it generally involves the following steps:

The traditional paper process can take weeks, even months. Dundas Life speeds up this process, saving you time and money.

Our intelligent quoting platform works without agents to deliver the right solution straight to your inbox

Our intelligent quoting platform works without agents to deliver the right solution straight to your inbox